Late on Thursday night, the World Bank’s board of directors gave final approval to a $500 million initiative in Brazil that will increase sustainability-linked financing, improve the private sector’s ability to access carbon credit markets, and aid Brazil in reducing deforestation and meeting climate goals.

The program uses a sustainable lending strategy in collaboration with the Brazilian state-controlled lender Banco do Brasil to assist Brazil in meeting its climate commitments and offer “substantial” mitigation benefits.

Brazil tries to fight a murky carbon credit market

When a corporation meets certain environmental, social, and governance (ESG) requirements, sustainability-linked financing (SLF) enables cheaper financing costs. Still, it does not mandate that the money be utilized for environmentally benign activities.

In an effort to clear up the murky carbon credit market and assist developing nations in rapidly and more affordably raising critical climate finance, the World Bank and its partners have a global tracking system that was launched at the start of December.

They sold carbon credits to polluters to offset their emissions in an effort to assist them in achieving net-zero emissions and decreasing global warming. Actions like planting trees and removing climate-damaging carbon dioxide from the atmosphere created these credits.

Brazil must reach climate goals by 2030

According to the World Bank, Brazil will need to reduce emissions by up to 90 million CO2 by 2030, or 4.5%, in order to meet its net-zero targets.

Through the expansion of finance provided by Banco do Brasil and private investors, the project is supposed to raise up to $1.4 billion in private money.

According to Johannes Zutt, the World Bank’s country director for Brazil, the country has a great deal of potential to take the lead in the world’s transition to a low-carbon economy. In order to achieve this, there is a need of quick action to combine private financing and solutions with public initiatives.

World Bank’s new initiative to fund climate goals

According to the World Bank, the initiative uses an innovative, outcome-based funding strategy that encourages businesses to adopt and implement reliable GHG emission reduction strategies to lower their overall carbon footprint.

It also connects these businesses to high-quality carbon markets.

According to the World Bank, Banco do Brasil will be able to provide its clients with packages that combine financing and assistance in accessing carbon markets through a “one-stop shop.”

Small and medium-sized businesses in Brazil will benefit from having access to an end-to-end service that starts with assessing their carbon footprint and ends with earning money from high-integrity carbon credits, according to the statement.

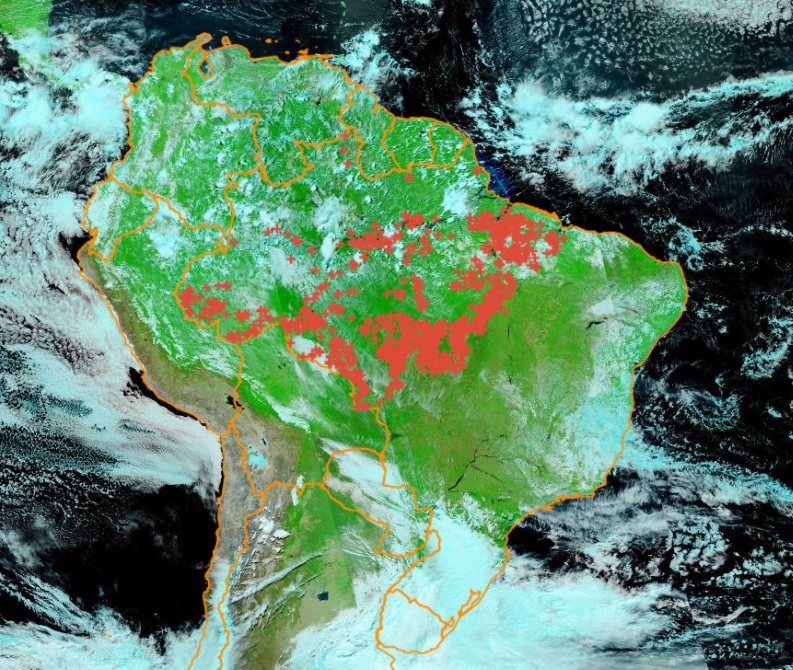

Brazil’s incoming president, Luiz Inacio Lula da Silva, has a comprehensive plan for the nation to reclaim its position as a global leader in climate change measures after the Bolsonaro administration abandoned them. Part of this plan includes stopping deforestation in the Amazon, which absorbs enormous amounts of the planet-warming greenhouse gas.